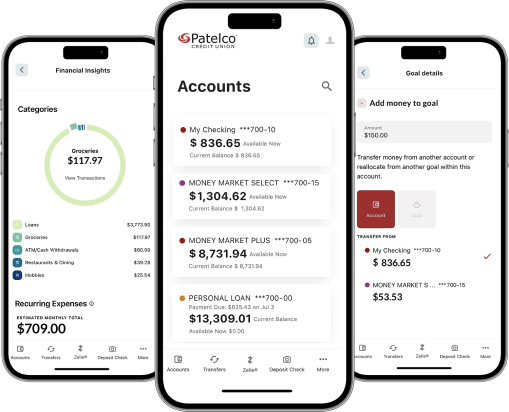

Resources to build your financial wellbeing

Secure access to your accounts.

Anywhere. Anytime.

Track purchases

Check your balance and get personalized insights on spending habits

Stay secure

Monitor your credit score, add a trusted contact, set alerts and more

Move money

Transfer money between accounts, pay friends or bills, and deposit checks

Plan and save

Create financial goals for life events and auto-save with each purchase