Social Security is a federal benefits program that provides a source of income for retirees. Most jobs deduct Social Security taxes from your paycheck. Then, when you retire, you get monthly checks. Your Social Security benefit is based on the number of years you worked and how much you earned.

Social Security benefits are not intended as your only source of retirement income. You may need other savings, investments, pensions, or

retirement accounts to ensure you have enough money when you retire. (There are also Social Security benefits for people who cannot work due to a disability, but this article is primarily about Social Security as a source of income for retirees.)

Who is eligible for Who is eligible for Social Security benefits?

You. You’re eligible for Social Security benefits if you’re 62 or older and have worked and paid Social Security taxes for 10 years or more.

Some jobs — such as state and local government positions held in 1983 or earlier — didn’t pay Social Security taxes and therefore don’t contribute to eligibility. People who were federal government workers after 1983, however, are eligible for Social Security. State government workers should contact their state Social Security administrators to check their eligibility.

Your current or former spouse. Social Security benefits may be available to your spouse, even if they haven’t worked or paid Social Security taxes for 10 or more years. Your spouse’s Social Security benefit may be up to 50% of your benefit at full retirement age. To qualify, your spouse must be at least 62 years old, be caring for a child 16 or younger, or be caring for a child with a disability.

Your domestic partner (in some cases). People in non-marital legal relationships such as a civil union or domestic partnership may be entitled to the same benefits as a married person. State law determines whether someone’s partnership qualifies them for Social Security benefits. In California, for example, domestic partners are eligible for Social Security benefits.

Your children. If you’re eligible for Social Security because you’re retired or have a disability, your children may also be eligible for benefits. They may qualify if they are unmarried and under age 18, or if they are 18 or 19 years old and attend elementary or high school full time. They may also be eligible if they are at least 18 years old and have a disability that began before they turned 22.

Your dependent parent. If you become disabled or die and your parent is (or was) dependent on you for at least half of their support, they may be eligible for Social Security benefits. They must be at least 62 years old and be your biological parent (or have become your stepparent or adoptive parent before you turned 16). If they married after you became disabled or died, they are no longer eligible.

The SSA offers a

helpful tool to determine eligibility for benefits.

Types of Social Security benefits

There are four primary types of Social Security benefits:

-

Retirement benefits provide a monthly check that replaces part of your income when you reduce your hours or stop working altogether. Your monthly Social Security checks might not replace all your income, so it’s important to have a

retirement plan. You can

check your Social Security account to compare how much you’ll receive if you retire at, for example, age 62, 65, or 70.

Keep in mind that if you sign up for

Medicare Plan B, which covers doctors’ services and outpatient care, your health care premium amount will be deducted from your monthly Social Security payment. (If you don’t receive Social Security, you’ll get a bill for Medicare Plan B.)

-

Social Security Disability Insurance (SSDI) pays benefits to you and certain family members if you’re blind or have a qualifying disability, you worked long enough (and recently enough), and you paid Social Security taxes on your earnings.

When you reach full retirement age, your SSDI benefits convert to retirement benefits. The benefit amount stays the same.

- Supplemental Security Income (SSI) is paid to eligible adults and children who have a disability, blindness, or are age 65 or older and have limited income and resources. It’s also available to adults 64 and under who are unable to work for one year due to a disability or have a disability that will result in death. The benefit amount depends on factors like your income, resources, marital status, and living arrangement.

- Survivor benefits go to widows, widowers, and dependents of eligible workers, such as children or dependent parents.

Spousal vs. survivor benefits The spouse of a Social Security beneficiary may receive spousal or survivor benefits.

Spousal benefits (for spouses) are available to spouses who didn’t work or didn’t earn enough to qualify for Social Security on their own (or whose benefit checks are small).

The spouse must be 62 or older, be responsible for a child under age 16, or receive Social Security disability benefits.

They may receive up to half of the benefit their spouse received at full retirement age. The benefit is lower if the survivor files before reaching their full retirement age.

Survivor benefits (for widows, widowers, and surviving ex-spouses) are available to a surviving spouse at full retirement age or at age 50 if the survivor has a disability. The benefit is also available to an ex-spouse who is at least 60, was married to the Social Security recipient for at least 10 years, and has not remarried.

If the survivor files before reaching their full retirement age, the benefit is reduced. If the spouse’s own Social Security benefit is higher than the survivor benefit, they can switch to their own benefit when they become eligible (through age 70).

Survivor benefits are also available to the person’s children who are either 17 or younger, are age 18 or 19 and a student, or are any age and developed a disability at age 21 or younger.

How are Social Security benefits calculated?

To calculate your Social Security benefits, the SSA uses the income for your 35 highest-earning years. If you worked for less than 35 years, the SSA uses a “0” for the years you didn’t work. The average annual earnings for those years get adjusted for inflation to arrive at your average indexed monthly earnings (AIME).

The SSA then uses your AIME to determine your primary insurance amount (PIA), the benefit amount you’d receive at full retirement age.

To calculate the PIA, the SSA uses three different percentages of portions of AIME. (This helps ensure that benefits are distributed fairly among our nation’s workers.)

For someone who first becomes eligible for Social Security benefits in 2025, the PIA formula is:

- 90% of the first $1,226 of the person’s AIME, plus

- 32% of his or her AIME over $1,226 and through $7,391, plus

- 15% of AIME over $7,391

Here’s how the SSA would calculate benefits, for example, using a hypothetical AIME of $5,000 for a worker retiring at full retirement age in 2025:

- 90% of the first $1,226 of AIME = $1,103.40

- 32% of AIME over $1,226 and through $7,391 = $1,207.68

- 15% of AIME over $7,391 = $0

Therefore, the worker’s PIA is $1,103.40 plus $1,207.68 plus $0, which comes to $2,311. (The amount gets rounded down to the nearest ten cents.)

How do I find out my Social Security benefit amount?

You can check your Social Security account to see your benefit amount. Your online statement provides secure, convenient access to estimates for retirement, disability, and survivor benefits. If you haven’t already set up your personal Social Security account, you can do so now.

What is COLA?

To keep up with inflation, The SSA adjusts benefits through cost-of-living adjustments (COLA). In 2025, for example, cost-of-living adjustment is 2.5%. The average monthly benefit check for retirees is $1,927, so that 2.5% COLA adjustment would bump it up to $1,976.

What is the maximum social security benefit?

The maximum social security benefit depends on your age. The older you are at retirement, the bigger your monthly benefit. In 2025, for example, the maximum benefit for those retiring at age 62 is $2,831. But the maximum benefit for those who wait until age 70 would be $5,108.

Are there any recent changes that I should be aware of?

In 2025, some former government workers will get a welcome surprise. On December 21, 2024, the Social Security Fairness Act became law, boosting benefits for more than 2.8 million public sector retirees, spouses, and surviving spouses.

Previous legislation — the Windfall Elimination Provision (WEP) and Government Pension Offset (GPO) — reduced Social Security benefits for employees in non-covered government jobs such as teachers, firefighters, and police officers.

The new act eliminates WEP and GPO, so those retirees will now receive a check for back pay going back to January 2024. The average back-pay check is $6,710 and checks began going out in March 2025. Recipients have also begun receiving larger monthly checks. If you have any questions, log into your Social Security account or call 800.772.1213.

What is the full retirement age for Social Security?

Full retirement age is between 66 and 67. The SSA uses full retirement age to determine your benefit amount and your family’s benefits. The longer you wait to apply for Social Security benefits, the higher your monthly payment will be, up until age 70.

Social Security retirement age chart

| Your Birth Year |

Your Full Retirement Age |

| 1943-1954 |

66 |

| 1955 |

66 and two months |

| 1956 |

66 and four months |

| 1957 |

66 and six months |

| 1958 |

66 and eight months |

| 1959 |

66 and ten months |

| 1960 |

67 |

If you were born on January 1, refer to the previous year to determine your full retirement age.

Taking Social Security early

You can begin receiving Social Security benefits before your full retirement age, as early as age 62

If you retire early, you may be able to collect for longer, but your monthly benefit will be less than if you wait until your full retirement age.

Your benefit is reduced by 5/9 of 1% for every month between your retirement date and your full retirement age, up to 36 months, then by 5/12 of 1% for each additional month. This reduction is permanent, meaning you won’t be eligible for a benefit increase once you reach full retirement age.

Even though your monthly benefit will be less if you retire earlier, you might receive the same or more total lifetime benefits as you would if you waited until full retirement age. That’s because even though you’ll receive less per month, you might receive benefits for more years.

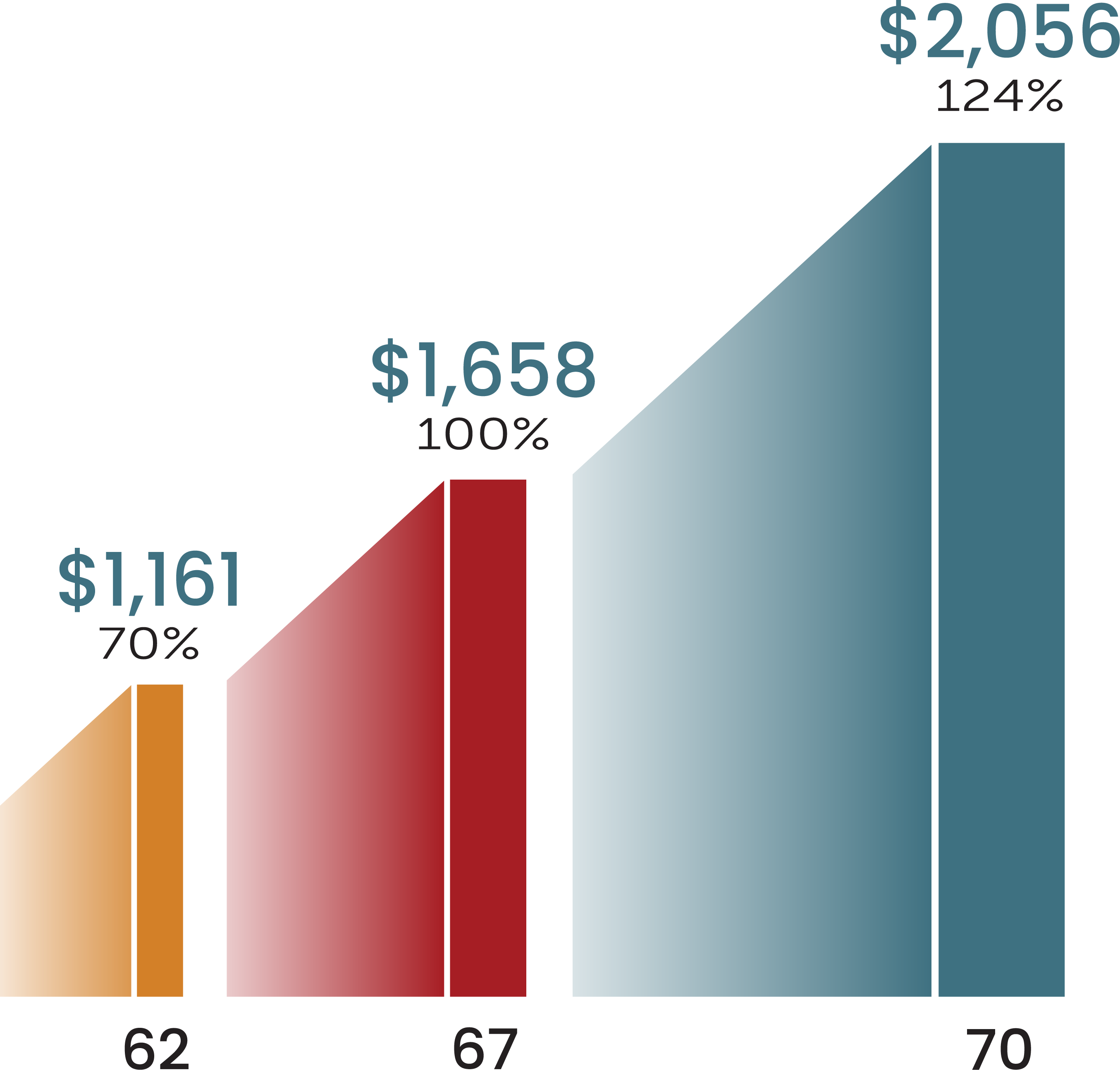

If you retire at your full retirement age, you’ll receive 100% of your primary insurance amount (PIA).

If you delay retirement benefits past your full retirement age, your benefit will permanently increase by a certain percentage, up to the maximum age of 70. For anyone born in 1943 or later, the monthly percentage is 2/3 of 1%, or an annual percentage of 8%.

As the following chart shows, for example, a monthly benefit that would be $2,000 if taken at a full retirement age of 67 would be just $1,400 if taken at age 62, and $2,480 if taken at age 70.

Are Social Security benefits taxable?

As of the beginning of 2025, about 40% of people who receive Social Security pay federal income taxes on at least some of their benefits.

You may pay taxes if you earn other substantial income — including wages, earnings from self-employment, interest, dividends, and other taxable income — in addition to your Social Security benefits.1

You may need to pay taxes on up to 85% of your Social Security benefits if your “combined income” meets certain criteria. Your combined income is your adjusted gross income plus non-taxable interest and half of your Social Security benefits for the year.1

- You’ll pay no tax on your Social Security benefits if your combined income is under $25,000 (single filer) or under $32,000 (joint filing).

- Up to 50% of your benefits can be taxed if your combined income is between $25,000 and $34,000 (single filer) or between $32,000 and $44,000 (joint filing).

- Up to 85% of your benefits can be taxed if your combined income is above $34,000 (single filer) or above $44,000 (joint filer).

Can you work and collect Social Security?

You can work and collect Social Security benefits at the same time. But if your annual earnings hit a certain number and you’re not at full retirement age, your benefits would be reduced.

If you’re younger than full retirement age during all of 2025, for example, $1 is deducted from your Social Security benefits for every $2 that you earn above $23,400. If you reach full retirement age sometime in 2025, $1 is deducted from your benefits for each $3 you earn above $62,160 until your birthday month.

Earnings are your wages or, if you’re self-employed, your net earnings. (Other government benefits, pensions, investment earnings, interest, and capital gains don’t count. But your own contributions to a pension or retirement plan do.)

Once you’ve reached your full retirement age, there is no limit on how much you can earn and still receive benefits.

In addition to federal taxes, some states also tax Social Security benefits. However, California does not tax Social Security, regardless of your income.

Sources:

Social Security Administration, “Eligibility for Social Security in retirement,” accessed May 12, 2025.

Social Security Administration, “Social Security Benefits for Federal Workers,” accessed May 12, 2025.

Social Security Administration, “How State and Local Government Employees Are Covered by Social Security and Medicare,” accessed May 12, 2025.

Social Security Administration, “Do You Qualify for Social Security Spouse’s Benefits?” updated April 18, 2025

Social Security Administration, “Who can get family benefits?” accessed May 12, 2025.

NOLO, “Social Security Benefits for Unmarried Couples,” updated October 16, 2024.

Social Security Administration, Benefits for Children 2025, accessed May 12, 2025.

Social Security Administration, Parent’s Benefits, accessed May 12, 2025.

Social Security Administration, “Social Security in Retirement,” accessed May 13, 2025.

Social Security Administration, “Are You 65 or Older and Need Medicare Part B? Sign Up Now Through March 31,” updated April 18, 2025.

US General Services Administration, “SSDI and SSI benefits for people with disabilities,” accessed May 13, 2025.

Social Security Administration, What You Need to Know When You Get Social Security Disability Benefits, p. 6, accessed May 13, 2025.

Social Security Administration, “Who can get SSI,” accessed May 13, 2025.

Social Security Administration, “How much you could get from SSI,” accessed May 13, 2025.

Social Security Administration, “Survivor benefits,” accessed May 13, 2025.

Social Security Administration, “Who Can Get Survivor Benefits,” accessed May 14, 2025.

Social Security Administration, “How do I apply for Social Security retirement benefits,” accessed May 14, 2025.

Social Security Administration, “Social Security benefit amounts,” accessed May 14, 2025.

Social Security Administration, “Benefit Calculation Examples for Workers Retiring in 2025,” accessed May 14, 2025.

Social Security Administration, “Your Retirement Age and When You Stop Working,” accessed May 14, 2025.

Social Security Administration, “2025 Social Security Changes,” accessed May 15, 2025.

CBS News, “Social Security sets its 2025 COLA increase at 2.5%. Here’s how it will change your benefits,” accessed May 15, 2025.

Social Security Administration, “What is the maximum Social Security benefit payable?” January 2, 2025.

Social Security Administration, “Social Security Fairness Act: Windfall Elimination Provision (WEP) and Government Pension Offset (GPO) update,” accessed May 22, 2025.

Kiplinger, “Social Security Fairness Act Payments Checklist: Nine Things to Know,” accessed May 22, 2025.

Social Security Administration, “Starting Your Retirement Benefits Early,” accessed May 15, 2025.

Social Security Administration, “Benefit Reduction for Early Retirement,” accessed May 16, 2025.

Social Security Administration, Retirement Benefits, 2025, p. 15.

Social Security Administration, “Information for Tax Preparers,” accessed May 16, 2025.

Social Security Administration, “Must I pay taxes on Social Security benefits?” October 14, 2022.

Kiplinger, “How to Calculate Taxes on Social Security Benefits in 2025,” updated the week of April 4, 2025.

Social Security Administration, How Work Affects Your Benefits, 2025, p. 2.