A paystub, or pay statement, provides a breakdown of what goes into your paycheck. It shows how much money you earned for that pay period. It also shows how much your employer deducted from your paycheck for income tax and benefits.

How many paychecks do I receive in a year?

That depends on your employer. Most people get paid on one of these schedules:

- Monthly (12 paychecks per year)

- Semimonthly (24 paychecks)

- Biweekly (26 or 27 paychecks)

- Weekly (52 paychecks)

How much taxes are deducted from my paycheck?

The federal government (IRS), state government, and sometimes local governments have their own tax rules. Here, we’re providing an overview of how federal and state taxes work.

Federal taxes

Your employer withholds federal taxes from your paycheck and sends that money to the IRS. Those funds help pay for all sorts of programs, from education and transportation to national defense. The main factors that go into calculating your federal taxes are your income and withholding allowances.1

Income

Your tax rate is primarily based on your annual income. For single people, as an example, the current marginal tax rate ranges from 10% of income for the lowest earners to 37% for the wealthiest earners.

But your income isn’t all taxed at one rate. Federal tax is “progressive,” meaning you pay different tax rates on income within different brackets, with the marginal tax rate being the highest tax you pay.

As of 2025, single taxpayers pay:

- 10% on their first $11,925 of income

- 12% on the portion of income from $11,926 to $48,475

- 22% on the portion of income from $48,476 to $103,350

- 24% on the portion of income from $103,351 to $197,300

- 32% on the portion of income from $197,301 to $250,525

- 35% on the portion of income from $250,526 to $626,350

- 37% on any income over $626,350

For 2025, you can find the tax brackets for other groups — married earners who file jointly, and heads of household —

here (see page 3).

Let’s say Mike is single and earns $50,000 of taxable income (his gross income minus any deductions and exemptions). For the first $11,925 of income, he pays 10% tax, which amounts to $1,192.50.

He then pays 12% tax on the portion of his earnings between $11,926 and $48,475. That portion is $36,549, so 12% tax would be $4,385.88.

Mike pays 22% on the rest of his income, the portion between $48,476 and $50,000, or $1,524. His 22% tax on that $1,524 is $335.28.

The three figures in bold add up to $5,913.66, which is Mike’s total income tax. The highest rate he pays is 22%, which is his marginal tax rate. But he only pays 22% tax on a small portion of his income. So Mike’s effective tax rate — the average rate he pays — is actually less than his marginal tax rate.

Rather than paying that $5,913.66 tax all at once, Mike’s employer withholds a small amount from every paycheck throughout the year. That amount is listed as Federal Withholding on his pay stub.

Withholding allowances

When you get a job — or make a major life change such as getting married — you fill out a Form W-4, so your employer knows how much money to withhold from your paycheck for income taxes.

Taxpayers can claim exemptions to reduce the amount of income that is taxed. Not long ago, workers chose the number of exemptions to claim on their W-4, such as 0, 1, 2, or more. Exemptions usually represent the number of children or other dependents the taxpayer has

In 2018, that changed. The

new Form W-4 guides you through five steps. Along the way, you answer questions that help your employer determine how much tax to withhold from your paycheck.

Step 1 asks for personal information like your name, address, and Social Security number.

Step 2 gives you options if you have more than one job, or if you file jointly with your employed spouse. You can either enter your income from all jobs or just the highest-paying one. If you don’t share your entire income, keep in mind that your employer may not withhold enough from your paycheck, meaning you may owe more on Tax Day.

Step 3 allows you to claim any dependents you might have.

Step 4 gives you the option to list itemized deductions, such as your home mortgage interest and charitable donations, rather than taking the IRS’s standard deduction. If your itemized deductions exceed the IRS’s standard deduction — $15,000 for individuals, $30,000 for couples filing jointly, or $22,500 for heads of household — then itemizing will reduce your tax liability. (Your deductions get subtracted from your income, and you pay tax on the remaining amount. So the larger your deductions, the lower your taxes.)

Step 5 simply involves providing your signature and the date.

State taxes

Your employer also withholds money from your paycheck to pay taxes to the state (such as California), to help fund everything from schools and universities to health initiatives and infrastructure projects.

Income

As with federal taxes, your taxable annual income determines your tax rate. So does your filing status, whether you’re single, married and filing jointly, a head of household, or a widow or widower.

You can typically find the current state tax rates on your state’s tax website. Just like federal income tax, state tax rates typically rises as your income increases.

State disability insurance

Your employer will withdraw a percentage (such as 1.2%) of your income to pay for state disability insurance, a state program that provides short-term disability coverage and paid family leave for eligible workers who need to take time off.

How to read a pay stub or paycheck

The pay stub (or pay statement) that you get with your paycheck details how much you were paid along with other useful information. Below, we explain the main components of a pay stub.

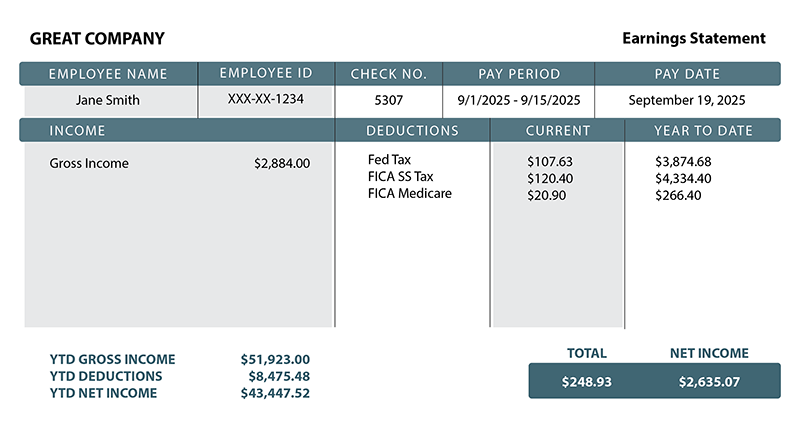

The statement below is an example only – note that your deductions will be different depending on your employer, state of residence, and tax situation.

Identifying information

You’ll see basic information like your name (and possibly address), Social Security number (usually partially masked), and employer’s name.

Pay period

The pay stub will show the pay period associated with that paycheck, such as “September 1, 2025 through September 15, 2025.” The stub may also include the total number of hours worked during the pay period, especially if you are paid hourly.

Gross wages

You’ll find your gross wages, which is the amount of money you earn before any payroll deductions (such as income taxes or benefits costs).

If you’re an hourly worker, that would be your hourly wage multiplied by the number of hours you worked that pay period. So if your hourly rate is $25, you get paid weekly, and you worked 40 hours last week, your gross earnings would be $25 times 40, or $1,000.

Salaried workers can divide their annual income by the number of pay periods in the year. If you make $75,000 a year and get paid biweekly, your paycheck would be $2,884 ($75,000 divided by 52 weeks x 2).

Taxes

Your pay stub also details the taxes withheld from your paycheck.

Those might include:

- Federal income tax, sometimes listed as FIT (federal income tax) or FITW (federal income tax withholding).

- State income tax, which is paid in some states. (In California, residents and nonresidents are typically taxed for income earned in California. It might be listed on your pay stub as California Personal Income Tax or California PIT.)

- FICA taxes. These taxes, created by the Federal Insurance Contributions Act, provide retirement and disability benefits to protect you at any stage of life. On your pay stub, it might appear as FICA, FICA SS, or simply Social Security. Your FICA tax consists of two main components:

- Social Security tax, also known as Old-Age, Survivors, and Disability Insurance (OASDI). This tax provides benefits to qualified retirees and disabled people who haven’t reached retirement age, as well as their dependents and survivors. On your pay stub, it might be listed as OASDI or OASDI/EE (EE means “employee expense.”).

- Medicare. Medicare entitles qualified employees to premium-free Medicare Part A — which covers hospitals, skilled nursing facilities, and hospice — when they become eligible. They can also access discounted optional coverage via Medicare Parts B, C, and D. Your pay stub might list this tax as Medicare or FICA Medicare.

- Other deductions. This could include state-mandated disability insurance, which helps fund short-term disability coverage and paid family leave. It may be listed on your pay stub as State SDI.

In some states, there are also other taxes paid by your employer. In California, for example, unemployment taxes are paid by employers.

Other deductions

Beyond federal and state income tax, other expenses may be deducted from your paycheck.

Some are pretax deductions, so they’re deducted from your gross income before income taxes get deducted. That means they reduce the amount of your income that’s taxed, lowering your taxes.

Possible pretax deductions include:

- health plans. If your employer provides health coverage, a portion of the premium may be deducted from your paycheck. Costs for a health savings account (HSA) or a flexible spending account (FSA) may also be deducted.

- life insurance, if your employer offers a policy.

- some retirement contributions, if you’re contributing to a 401(k) or IRA, for example.

- dependent care benefits, if your employer offers a dependent care assistance program that allows you to use pre-tax dollars to pay for childcare, after-school programs, and other eligible expenses.

Your paycheck may also include post-tax deductions such as:

- Roth IRA contributions.

- wage garnishment. A court, regulatory agency, or the IRS may order your employer to withhold some of your wages to pay for unpaid expenses such as alimony, child support, or taxes.

- voluntary deductions, such as life insurance coverage beyond your employer’s standard policy.

Net pay

Your net pay is the amount of your paycheck. It’s the amount you take home after any taxes and deductions are subtracted from your gross pay.

Have a Side Hustle?

If you have a side gig, make sure to take advantage of any business deductions, which can help lower your taxes. Expenses associated with running your business — like Internet fees, office supplies, and printing expenses — can often be deducted.

Sources:

Federal Trade Commission, “Your Paycheck Explained,” accessed July 9, 2025.

Consumer Financial Protection Bureau, “How to Read a Pay Stub,” Summer 2022.

US News & World Report, “22 Legal Secrets to Help Reduce Taxes,” February 26, 2025.

Kiplinger, “What’s the Standard Deduction for 2025? Changes You Need to Know,” accessed July 11, 2025.

SmartAsset, “How to Fill Out Your W-4 Form: Answers to FAQs About the W-4, updated November 25, 2024.

US News & World Report, “Filing 2025 Taxes: What’s My Tax Bracket?” November 5, 2024.

SmartAsset, “All About the FICA Tax,” March 18, 2025.

IRS, “Topic no. 751, Social Security and Medicare withholding rates,” accessed July 16, 2025.

Paychex, “FICA Tax: What Does It Mean and How Is It Calculated in 2025,” updated April 15, 2025.

AARP, “California State Taxes: What You’ll Pay in 2025,” January 16, 2025.

Employment Development Department (State of California), “Contribution Rates, Withholding Schedules, and Meals and Lodging Values,” accessed July 16, 2025.

Employment Development Department (State of California), “State Disability Insurance,” accessed July 16, 2025.

Employment Development Department (State of California), “California State Payroll Taxes – Overview,” accessed July 16, 2025.

Congressional Research Service, “Federal Individual Income Tax Brackets, Standard Deduction, and Personal Exemption: 1988 to 2025,” updated January 31, 2025.

Forbes Advisor, “What Are Pre-Tax Deductions?” July 22, 2024.

ADP, “What are payroll deductions? Pre-tax and post-tax,” accessed July 16, 2025.

Forbes Advisor, “What’s the Difference Between Your Marginal and Effective Tax Rate?” October 24, 2024.

California Tax Service Center, “Understanding Your Paycheck,” accessed July 18, 2025.

California Budget & Policy Center, “Guide to the California State Budget Process,” November 2024.

SmartAsset, “401(k) Tax Rules: Withdrawals, Deductions & More,” February 14, 2025.