How Do Checks Work?

January 15, 2024 • 7 mins

Article Contents

In the age of online banking, using checks has become something of a lost art. According to the Federal Reserve, the number of checks written in the United States declined 40.6 percent between 2015 and 2021 as the popularity of digital wallets and mobile payment apps has grown. That said, many businesses still prefer checks. Here’s how to write, endorse, cash, and void a check.

How to write a check

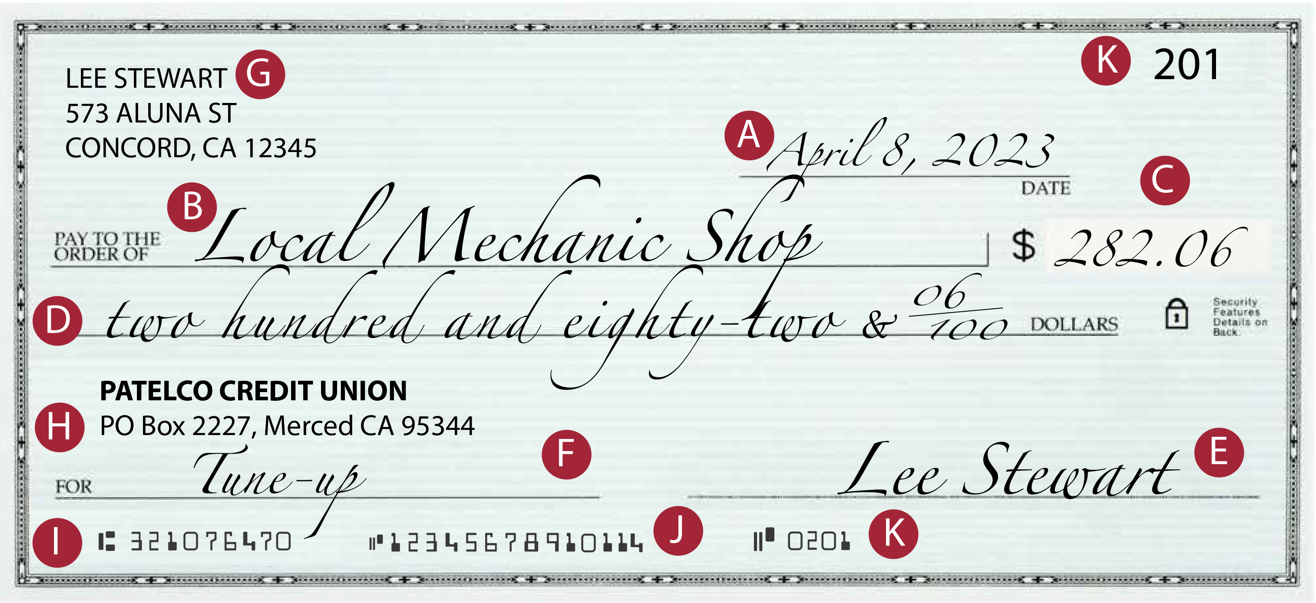

A typical check has several blank fields for you to complete. Here’s what you’ll need to enter:

- The date. First, start by entering today’s date in the upper right corner. You can spell out the month or use the numerical date (e.g. 4/8/2023).

You can enter a future date (also known as postdating) for the check if you want the recipient to wait before cashing the check. That doesn’t guarantee the payee will wait, however, so make sure you always have sufficient funds in your account.

- The payee. See that line that says “Pay to the Order of” on the front of your check? That’s where you’ll write the name of the organization or person you’re paying. It needs to be accurate, so ask the recipient who to make it out to.

- The numerical amount of the check. To the right of the “Pay to the Order of” line, you will need to write the amount you’re paying. It goes in the small box on the right side of your check. Use numbers (1, 2, 3, etc.) and start writing as close to the dollar sign ($) as possible — this can help prevent fraud.

Some tips: Since the dollar sign is printed on the check, you don’t need to write it in yourself. Always use a period after the number of dollars, and two decimal places when entering the number of cents, like this: 603.29. You can draw a line through any remaining space in the box to help prevent a fraudster from writing in additional numbers.

- The amount of the check in words. On the line below, you’ll need to write out the amount of the check like this: “Six hundred three and 29/100.” You’ll spell out the dollar amount and use a fraction (29/100) to indicate how many cents. Remember to include the word “and” or an ampersand or plus sign between your dollar amount and the cents.

More tips: You’ll want to keep the longhand amount to one line. Since “Dollars” is printed at the end of the line, you don’t need to write that out (or ”cents,” either). Avoid using “and” anywhere else on this line, such as between “hundred” and “three.” Finally, it’s better to write the amount out in capital letters — they’re harder to alter.

If the numerical amount of the check and the amount you wrote out don’t match, the bank will honor the amount written on the second line.

- Your signature. The blank line at the bottom right corner of your check is where you’ll sign it. Your name and signature should match what your bank has on file, and it should be legible, too. If your check isn’t signed, it isn’t valid.

Never sign your check before you’ve filled out the rest of it. Signed blank checks can be used for fraud.

- Memo (“For”) line. The memo line near the bottom right is where you can include information that the payee may need — your account number, for instance — or a reminder about the purpose of the check.

After you write your check, you’ll want to record details about the payment in your check register, the booklet that comes with your checks, or some other secure place, such as a paper notebook stored in a safe place, or in a spreadsheet that’s secure. In there, you can log the check number, date, the amount of the payment, and what the check was for. If you’re using a check register or spreadsheet, you may also want to record how this check (when cleared) will affect your account balance. A check register or spreadsheet is helpful for tracking your spending in this way so you don’t bounce checks, and also so you can see where your money goes.

Keeping track of expected transactions will also help you spot unexpected transactions – helping you avoid fraud.

Other parts of a check

A typical check has several other pre-printed fields. Here’s what they are:

- Your name and address. These are typically printed in the upper left of the check. It helps the payee (especially if it’s a business) match the money to the right account.

- The financial institution. This tells the payee (and the payee’s bank or credit union) where your account is held, such as Patelco Credit Union.

- The routing number. This is your credit union’s routing number – a unique 9-digit number used to identify a financial institution in the United States.

- Your account number. When your check is cashed or deposited by the payee, Patelco pays them the amount of your check – and then withdraws that amount from your account. That’s why your check includes your account number, so Patelco will know what account to withdraw your funds from. Because checks include your account number, you should not give checks to individuals or businesses you don’t trust.

In some cases, checks may not be the best mode of payment because of the personal information – including name, address, and account number – that is included on a check. For each transaction, you may want to consider cash, electronic payments, or Bill Pay in addition to checks and decide which one is the most appropriate.

- The check number. Checks typically come in a book of checks, and each check has a number – this is to help you keep track of who you wrote each check to, and the amount. In online banking or the Mobile App, you are able to see the check number so you can tell which checks have been cashed or deposited by the payee.

How to endorse a check

In order to cash or deposit a check, you need to endorse your check by signing your name on the back, on one of the blank lines that may have an “X” or read “Endorse here.” Your signature should be in blue or black ink and match the one your credit union (or other financial institution) has on file.

There are a few types of endorsements, including:

- A blank endorsement, which is just your signature with no additional instructions.

- A restrictive endorsement, which includes your signature and “for deposit only.” This means the check can be deposited into a bank account but not cashed. If you include your bank account number, the check can only be deposited into that account.

- A mobile endorsement. Some financial institutions may require you to endorse your check with “for deposit only” to deposit a check using your mobile banking app.

When using Patelco’s remote deposit in our Mobile App, you’ll need to write “Patelco CU Mobile Deposit” below your signature on the back of the check you’re depositing.

- A business endorsement. For checks made out to a business name, a business endorsement allows someone who works for the company to sign the check. In this case, the employee would print the name of the company and their job title above their signature.

- An endorsement in full, which allows you to give the check to someone else to endorse and cash or deposit as a third-party check. To do this, you’ll write “Pay to the order of” and the name of the recipient in the endorsement. Your signature will go below those details.

A check register is a useful tool for seeing where your money goes, detecting fraud, and tracking your spending so you don’t bounce checks.”

How to cash a check

Whether you’ve received a check from a person, a business or an organization, you’ll want to cash it or deposit it. You’ll need to show your photo ID to verify that you are the intended recipient of the check, and you’ll need to endorse the check as outlined above. Financial institutions like Patelco will recommend that you hold off on signing the check until you’re ready to deposit or cash it.

The easiest place to cash a check is at your own credit union, or at the branch of the bank or credit union that issued the check.

How to cash a check without an account

If you don’t have a credit union or bank account, the best option is to go to the check’s issuer. (Don’t forget your photo ID!) You may be charged a fee if you’re not an account holder there, however.

If you can’t get to the issuing bank or credit union, you can also go to some major retailers, grocery stores, or check-cashing stores. Many stores may only cash business and payroll checks — not personal checks —and they’ll also charge a fee. Beware of check-cashing stores: they may advertise that they’ll cash any type of check, but they’ll also charge a significant fee for the service. Some locations may charge you 10 percent of the value of the check – or even more! This is why it’s best to have your own checking account.

You can also deposit the check into some prepaid card accounts. Some prepaid cards allow you to make mobile deposits using an app on your phone, or if the card is associated with a bank, you can use the bank’s ATM to make the deposit. Beware of fees that may be associated with doing this. Again, it’s best to have your own checking account.

How to void a check

There are a few reasons to void a check. You might need to provide a voided check to set up direct deposit (your employer will want your account and bank routing numbers), or maybe you made a mistake when you were writing out a check. Once a check is voided, it can’t be cashed or deposited.

Here’s how to void a check: Simply write “VOID” in large letters across the front of the check in blue or black ink. You can also write “VOID” on each line of the check.

You can’t void a lost check, but you can contact your financial institution to request a stop payment to keep your money safe if someone deposits or cashes it. You’ll need to provide the check number, payee and amount. This is why it’s a good idea to keep a record of check numbers and who you wrote the check to and for what amount.

How to protect your checks

Take your outgoing mail to a collection box as close to the indicated pick-up time as possible. Or drop off inside the post office for mailing.

If you choose to leave outgoing mail in your mailbox, don’t ever put your mail flag up. Try not to leave incoming or outgoing mail sitting in your mailbox for an extended period of time, particularly overnight.

Sign up for Informed Delivery, a USPS free service at usps.com. With this service, you will receive an email with images of everything that will be delivered to your home that day, so you’ll know what to expect (and what’s missing when the carrier drops off your mail).

If you are going to be out of town, have a neighbor collect your mail or use the USPS Hold Mail service.

Keep an eye on your bank accounts for potential fraud, and report suspicious activity as soon as possible.

Use the right pen

Thieves and organized crime rings are working overtime to snatch your mail in hopes of finding checks they can alter. While the vast majority of mail sent through the U.S. Postal Service (USPS) — which handles over 100 billion pieces a year — arrives without incident, mail theft and mail carrier robberies are a growing problem around the US. Thieves will then “wash” the stolen checks with a basic household chemical that can dissolve many kinds of ink. They then make it out to whomever they want, change the dollar amount and forge a signature. They may even put superglue over the original signature of the check while washing it to keep it looking authentic. They take their crime one step further and recruit people hurting financially to serve as “runners” and “finish the job.” The runner’s job is to deposit the forged check, then withdraw the money to give to the criminals; this is illegal.

Gel pens are designed with pigments suspended in a water-based gel, which makes them resistant to most chemicals. These pens can also work on surfaces that other pens wouldn’t, especially porous materials. When you use gel pens, you not only maintain the quality of your checks but also make them tamper-proof from any washing attempts.

Why are gel pens superior to regular ones? Traditionally, people use ballpoint pens to write checks, but their ink can easily be removed by several chemicals. Such pens use oil-based ink, which settles on the paper’s surface. Once the paper is soaked in water or any other chemical, the ink can wash off with ease. Therefore, switching to gel ink pens is the best way to protect yourself from check washing threats. Gel ink not only binds to the paper better but also dries faster and does not smear, making it easier to read and more durable than ballpoints.

Learn More About Banking

September 28, 2023

Even digitally savvy people can be victims of a fake check scam. Sadly, certified and cashier check scams are on the rise. Learn how to spot and avoid check cashing scams.

August 3, 2020

Don’t be fooled by the marketing of short-term, emergency and payday loans online. Get the facts on the true cost of payday loans from Patelco.

October 9, 2019

Inflation has increased the prices of many things, including gas, food, and utilities. The good news is that it’s possible to save money on all these things. Check out our tips that can work for everybody.