Checking Accounts

The right checking account helps build your finances on a strong foundation. Explore our checking solutions tailored for your unique needs.

Free Checking

Take advantage of no fees or minimums with our everyday, worry-free checking account.

Plus Checking

A one-of-a-kind checking account with exceptional benefits and discounts.

Interest Checking

Earn interest on an everyday account and easily waive the monthly fee.

Student Checking

Teach teens to be money smart with no monthly fees and daily limits.

How to compare types of checking accounts

Checking accounts have different features and fees. Most allow you to write checks, use a debit card, pay bills online, and send digital payments — but how do you choose the right type of checking account for you? To help you choose, ask yourself these questions.

Monthly Fees

Is it important to avoid paying fees on your account?

Opening Deposit Requirements

Do you have money to transfer into the account now?

Minimum Balance Requirements

Are you able to keep enough money in your account?

Earning Interest

Do you want to earn interest on your deposits over time?

Overdraft Fees

Do you worry about spending more than you have in your account?

Added Benefits

Are you looking for added perks, like ID theft protection, discounts, etc?

Checking with all the benefits you expect, plus more

ATMs Galore

30,000+ Fee-free ATMs nationwide

Debit Mastercard®

The convenient and secure way to pay in

person or online

Get Paid Early with Direct Deposit1

Set up direct deposit to your checking account and access your funds up to two days early

Mastercard© ID Theft Protection™

No-cost personal information protection with your debit Mastercard® for checking accounts

Overdraft Protection

Say goodbye to fees and overdrawn checking accounts when you link certain accounts

RoundUp

We’ll round up your debit purchases to the nearest dollar and deposit it into your savings.

Securely log in to Patelco Online™ or our easy-to-use app to check account balances and FICO® score for free, send money, pay bills, make a mobile deposit, set up account alerts, and more. Get started today with Patelco Online™ or our top-rated Mobile App.2

Checking Account FAQs

-

A checking account allows you to make unlimited withdrawals and deposits designed to allow for day-to-day cash movement. You can easily access your money through digital banking transactions, debit cards, ATMS and old fashioned checks.

It’s easy to set up direct deposit to your Patelco checking account in just a few steps. Log in to our Mobile App or Patelco Online™ to get started. Click here to set up your Direct Deposit or watch this step-by-step demo to learn more.

You can also download the Patelco Direct Deposit authorization form and fill it out manually. Give the completed form to your employer or benefit provider. Remember to use the correct account number formats. In Patelco Online™ tap on your checking account, then select the Account Details tab (look for Account Number for Direct Deposit and ACH Transactions).To join us, you’ll need: Social Security number (or acceptable government-issued document showing your Tax Identification Number), driver’s license or government ID, current home address, and an external bank account to fund your new account (only for accounts opened online).

Yes, checking accounts are insured by the FDIC or NCUA up to $250,000 per depositor, per insured bank.

Patelco is a member owned, not-for-profit financial cooperative. When you open an account at Patelco, you become a member and a shareholder. That’s why we’ll deposit one share ($1) in your Share Savings account when you join. Our mission is to help members achieve lifelong financial well-being so you can live happier, fuller lives. Unlike the big banks or other for-profit financial institutions, we invest our profits back in our members with better rates and low- to no fees.

Typically, there’s no minimum deposit to open a Patelco Checking account, but it can vary depending on the checking account type you may choose. Please see the specifics for the type of account you’d like to open above using our compare tool.

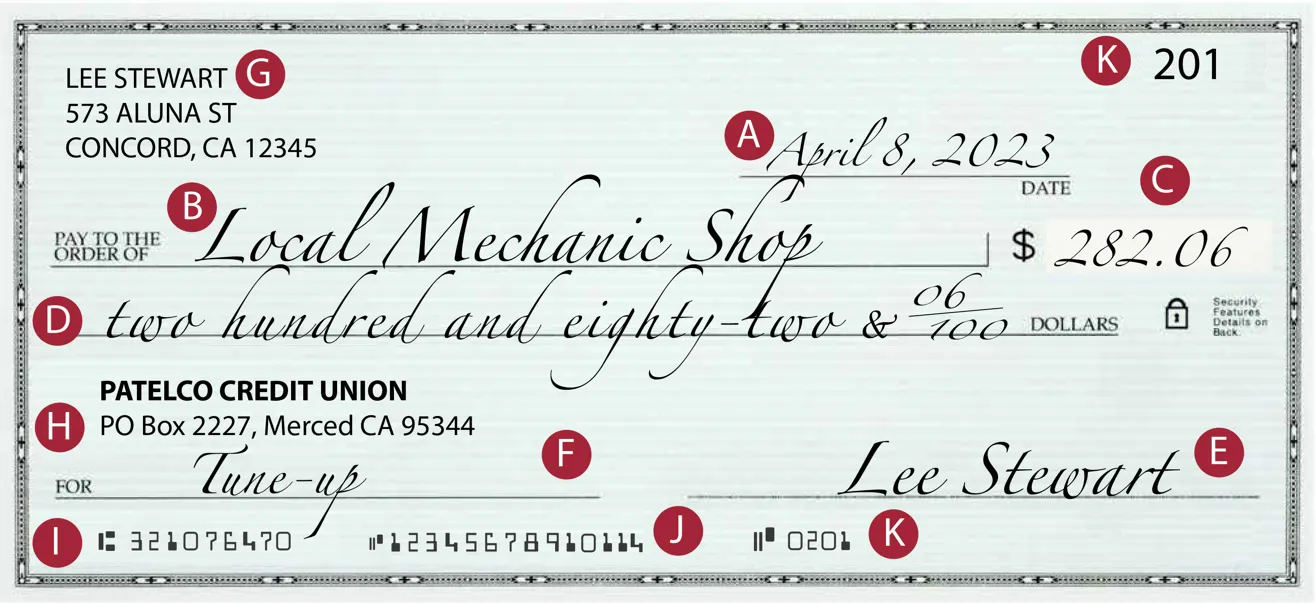

Our routing number is 321076470. For most accounts, your full account (MICR) number can be found by clicking or tapping on the account in Patelco Online™ and then selecting the Account Details tab. Your checking account number is 14 digits long.

If you have checks, the Patelco routing number 321076470 appears along the bottom of your checks, to the far left, while your full account (MICR) number appears along the bottom of your checks, to the right of the routing number.

You’ll find the routing number by referring to “I” and the account number by referring to “J” in the image below.

Watch this short step-by-step demo to learn how to find your routing or account number using the Mobile App.

1 Early access to direct deposit funds depends on the timing of the submission of the payment file from the payer. We generally make these funds available on the day the payment file is received, which may be up to 2 days earlier than the scheduled payment date.

2 Source: Over 34,700 5-star reviews across Apple iOS and Google Play app stores.